The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Austin Predicted to be Hottest U.S. Housing Market of 2021

Residential News » Austin Edition | By Michael Gerrity | January 20, 2021 8:40 AM ET

Expensive New York, San Francisco and Los Angeles most likely cities to underperform

Zillow research is predicting that Austin, Texas will be America's hottest housing market in 2021, leading a list of mostly Sun Belt cities expected to continue heating up faster than the nation's large coastal markets.

The booming Texas destination heads a lineup of sunny and relatively affordable metro areas -- Phoenix, Nashville, Tampa and Denver -- that are most likely to outperform the nation in home value growth, according to a panel of economists and real estate experts recently surveyed by Zillow.

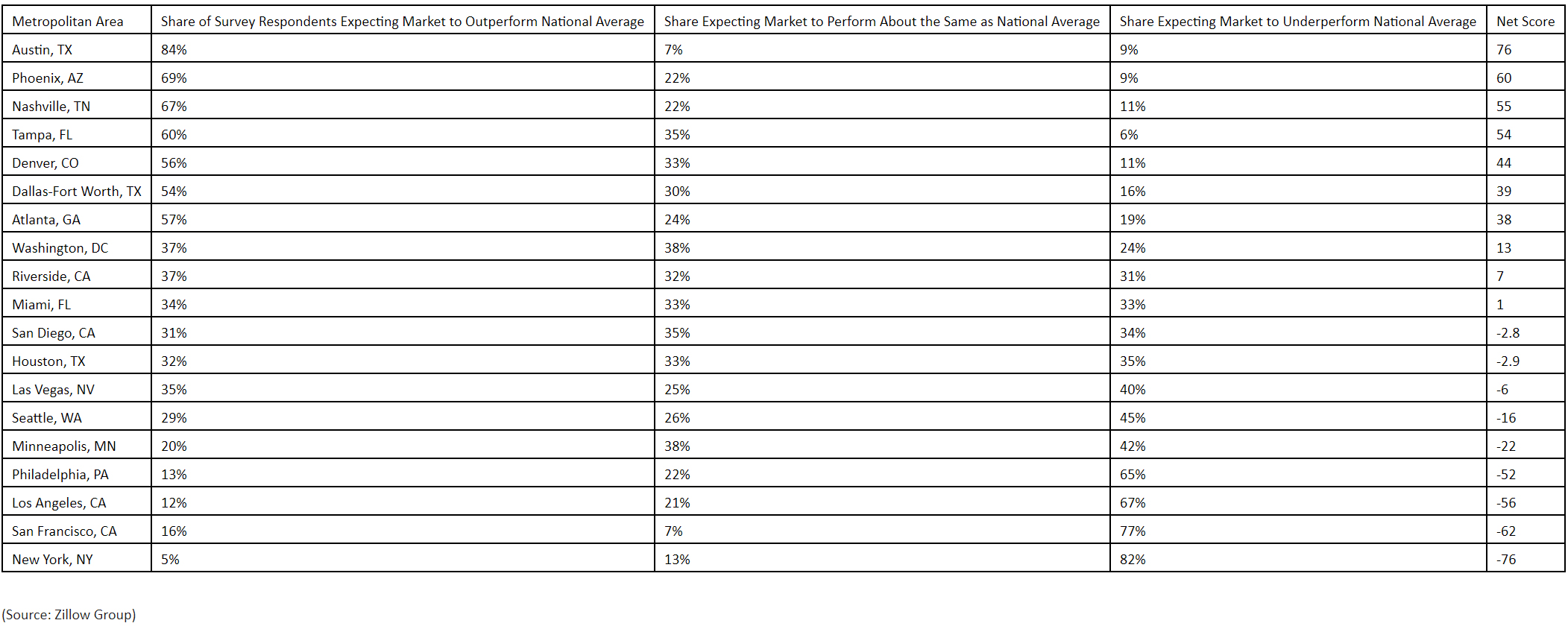

The Zillow Home Price Expectations Survey, sponsored by Zillow and conducted quarterly by Pulsenomics LLC, asks a large panel of economists, investment strategists and real estate experts for their predictions about the U.S. housing market. The Q4 survey also asked about their expectations for 2021 home value growth in 20 large markets compared to the nation.

An overwhelming 84% of those surveyed said Austin values would out-perform the national average, compared to just 9% who believe it would fare worse. Phoenix came in second with 69%, followed by Nashville (67%), Tampa (60%), and Denver (56%). Page views on Zillow for-sale listings in Austin by out-of-town searchers were up 87% in November compared to 2019.

The top-five metros are all affordable options compared to expensive coastal areas that have led home appreciation ranks in recent years, providing relative value for Millennials looking to take advantage of low mortgage rates to buy their first home. The top five are also, for the most part, sunny locales. Four of the five counties holding the largest cities in these MSAs all rank in the top-third of counties in the contiguous U.S. for average daily sunlight, according to NASA data analysed in The Washington Post. Davidson County, home to Nashville, ranked just below the midline.

"The pandemic has not upended the housing market so much as accelerated trends we saw coming into 2020," said Zillow senior economist Jeff Tucker. "These Sun Belt destinations are migration magnets thanks to relatively affordable, family-sized homes, booming economies and sunny weather. Record-low mortgage rates and the increased demand for living space, coupled with a surge of Millennials buying their first homes, will keep the pressure on home prices there for the foreseeable future."

An improved economic outlook thanks to COVID-19 vaccine roll-outs and better treatments was pegged as the most likely tailwind for the housing market in 2021, followed by sustained strength in first-time home buying among Millennials. It proved a powerful demand driver in 2020 and is expected to persist for years to come.

Austin Texas was predicted to be the hottest market in last year's survey, and that proved true. By mid-December 2020 the median list price for homes in the Austin metropolitan area was up 23.6% year over year -- the largest rise among the 50 largest U.S. markets.

"During the pandemic I think a lot of people spending a big portion of their paycheck on rent or mortgage in cities like New York and San Francisco started working from home and suddenly had options. Their dollar goes a lot further in the South, the climate is better, and Austin has a lot to offer -- from the food scene to outdoor activities and live music," said Thomas Brown, CEO of The Agency Texas. "Those factors are going to continue drawing people into the Austin market in 2021."

Expensive coastal cities are predicted to fall short of the national average -- 82% of respondents said New York would see sub-par growth in 2021. San Francisco (77%) and Los Angeles (67%) round out the bottom of the 20-city list.

Tight supply conditions and affordability concerns were each cited by 29% of the panelists as the greatest headwind.

"While sustained tailwinds are forecasted this year across most of the shifting U.S. housing landscape, certain densely populated markets with high-priced real estate face prevailing headwinds," said Terry Loebs, founder of Pulsenomics. "Accordingly, home value appreciation rates within coastal cities such as New York, San Francisco, and Los Angeles are projected to see a downshift from last year's remarkable levels."

Zillow research is predicting that Austin, Texas will be America's hottest housing market in 2021, leading a list of mostly Sun Belt cities expected to continue heating up faster than the nation's large coastal markets.

The booming Texas destination heads a lineup of sunny and relatively affordable metro areas -- Phoenix, Nashville, Tampa and Denver -- that are most likely to outperform the nation in home value growth, according to a panel of economists and real estate experts recently surveyed by Zillow.

The Zillow Home Price Expectations Survey, sponsored by Zillow and conducted quarterly by Pulsenomics LLC, asks a large panel of economists, investment strategists and real estate experts for their predictions about the U.S. housing market. The Q4 survey also asked about their expectations for 2021 home value growth in 20 large markets compared to the nation.

An overwhelming 84% of those surveyed said Austin values would out-perform the national average, compared to just 9% who believe it would fare worse. Phoenix came in second with 69%, followed by Nashville (67%), Tampa (60%), and Denver (56%). Page views on Zillow for-sale listings in Austin by out-of-town searchers were up 87% in November compared to 2019.

The top-five metros are all affordable options compared to expensive coastal areas that have led home appreciation ranks in recent years, providing relative value for Millennials looking to take advantage of low mortgage rates to buy their first home. The top five are also, for the most part, sunny locales. Four of the five counties holding the largest cities in these MSAs all rank in the top-third of counties in the contiguous U.S. for average daily sunlight, according to NASA data analysed in The Washington Post. Davidson County, home to Nashville, ranked just below the midline.

"The pandemic has not upended the housing market so much as accelerated trends we saw coming into 2020," said Zillow senior economist Jeff Tucker. "These Sun Belt destinations are migration magnets thanks to relatively affordable, family-sized homes, booming economies and sunny weather. Record-low mortgage rates and the increased demand for living space, coupled with a surge of Millennials buying their first homes, will keep the pressure on home prices there for the foreseeable future."

An improved economic outlook thanks to COVID-19 vaccine roll-outs and better treatments was pegged as the most likely tailwind for the housing market in 2021, followed by sustained strength in first-time home buying among Millennials. It proved a powerful demand driver in 2020 and is expected to persist for years to come.

Austin Texas was predicted to be the hottest market in last year's survey, and that proved true. By mid-December 2020 the median list price for homes in the Austin metropolitan area was up 23.6% year over year -- the largest rise among the 50 largest U.S. markets.

"During the pandemic I think a lot of people spending a big portion of their paycheck on rent or mortgage in cities like New York and San Francisco started working from home and suddenly had options. Their dollar goes a lot further in the South, the climate is better, and Austin has a lot to offer -- from the food scene to outdoor activities and live music," said Thomas Brown, CEO of The Agency Texas. "Those factors are going to continue drawing people into the Austin market in 2021."

Expensive coastal cities are predicted to fall short of the national average -- 82% of respondents said New York would see sub-par growth in 2021. San Francisco (77%) and Los Angeles (67%) round out the bottom of the 20-city list.

Tight supply conditions and affordability concerns were each cited by 29% of the panelists as the greatest headwind.

"While sustained tailwinds are forecasted this year across most of the shifting U.S. housing landscape, certain densely populated markets with high-priced real estate face prevailing headwinds," said Terry Loebs, founder of Pulsenomics. "Accordingly, home value appreciation rates within coastal cities such as New York, San Francisco, and Los Angeles are projected to see a downshift from last year's remarkable levels."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Orlando's Housing Market Continues to Slow Down This Fall

- U.S. Mortgage Originations Predicted to Hit $1.95 Trillion in 2024

- Construction Input Costs in America Uptick in September

- Global Home Price Growth Further Slows in Mid-2023

- Home Values in U.S. Begin to Slip Late Summer

- Foreclosure Filings in U.S. Spike 34 Percent Annually in Q3

- U.S. Mortgage Credit Availability Upticks in September

- Retail Market is a Bright Spot for Manhattan Real Estate

- Residential Rents in U.S. Dip in September Amid Growing Apartment Supply

- U.S. Mortgage Rates Continue to Surge in October

- Greater Las Vegas Home Sales Down 10 Percent Annually in September

- Most U.S. Homebuyers Say Buying a Home is More Stressful Than Dating in 2023

- Mortgage Applications Dive 6 Percent Last Week in America

- Despite Peak Interest Rates, Global Housing Markets Improved in Q2

- U.S. Architecture Billings Index Reports Softening Business Conditions in August

- U.S. Home Price Growth Pace Upticks Again in August

- 10,000 Residential Properties Have Negative Equity in Hong Kong

- U.S. Pending Home Sales Dropped 7.1 Percent in August

- U.S. Mortgage Rates Reach Highest Level in 23 Years

- American Bankers See Weakening Credit Conditions Through End of 2024

- Palm Beach Area Residential Sales Uptick in August

- Driven by High Mortgage Rates, Pending Home Sales Drop 13% Annually in September

- Miami Area Residential Sales Slip 13 Percent Annually in August

- U.S. Home Sales Dip 15 Percent Annually in August

- Home Flipping Transactions Down in 2023, Profits Up

- U.S. Listings Inventory Rises 4 Percent in August

- The Fed Leaves Rates Alone for Now in September

- Mortgage Applications Uptick in U.S. Amid High Rates

- Single Family Rent Growth in U.S. Drops to 3-Year Low in July

- Greater Orlando Area Home Sales Down 16 Percent Annually in August

- Home Purchase Cancellations Accelerating in the U.S.

- U.S. Construction Input Costs Uptick in August

- U.S. Mortgage Credit Availability Upticks in August

- Monthly Property Foreclosure Activity Upticks in U.S.

- Greater Palm Beach Area Residential Sales Dip 5 Percent Annually in Mid-2023

- NAR Predicts Several U.S. Housing Market Outcomes

- Demand for U.S. Housing is Dropping as Prices Rise

- U.S. Homeowner Equity Decrease by $287 Billion Over the Last 12 Months

- 1 in 5 Millennials Think They'll Never Own a Home in America

- 1 in 8 San Francisco Home Sellers Is Losing Money at Closing in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More