Residential Real Estate News

U.S. Housing Market Has 40 Percent Less Active Listings in 2023 Than Before the Pandemic

Residential News » Seattle Edition | By WPJ Staff | June 20, 2023 8:54 AM ET

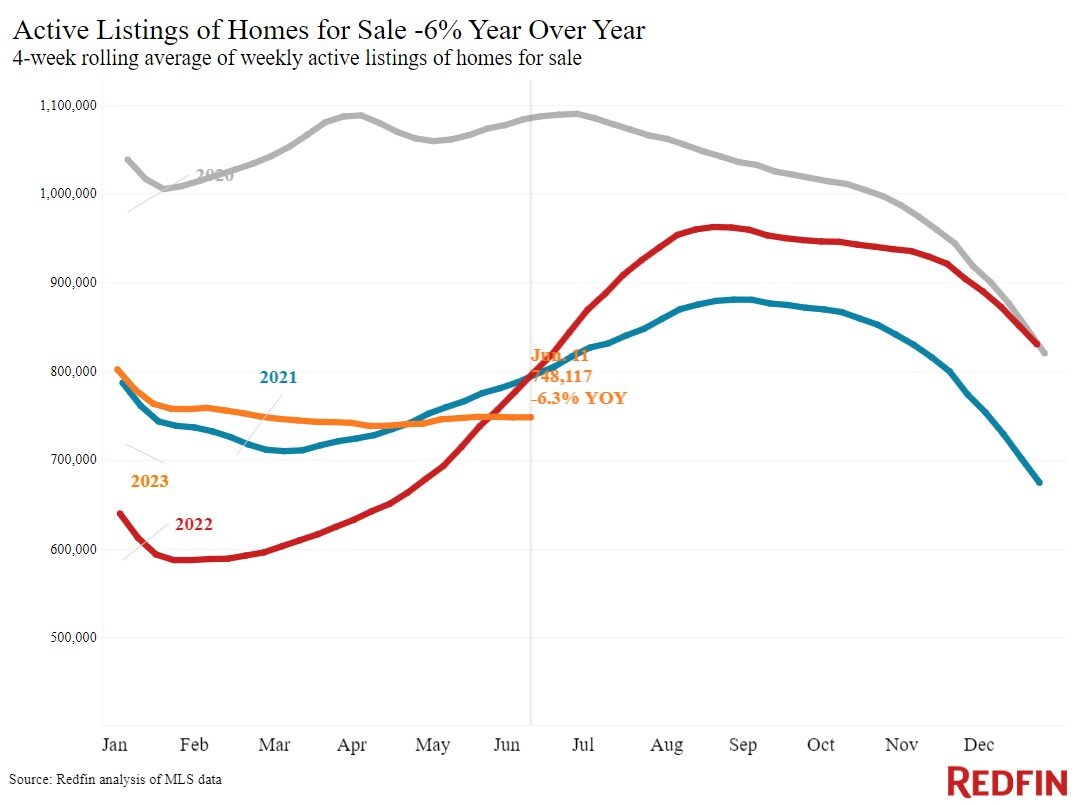

According to a new report from national property broker Redfin, the total number of U.S. homes for sale dropped 6% from a year earlier during the four weeks ending June 11, 2023, the biggest decline in 13 months.

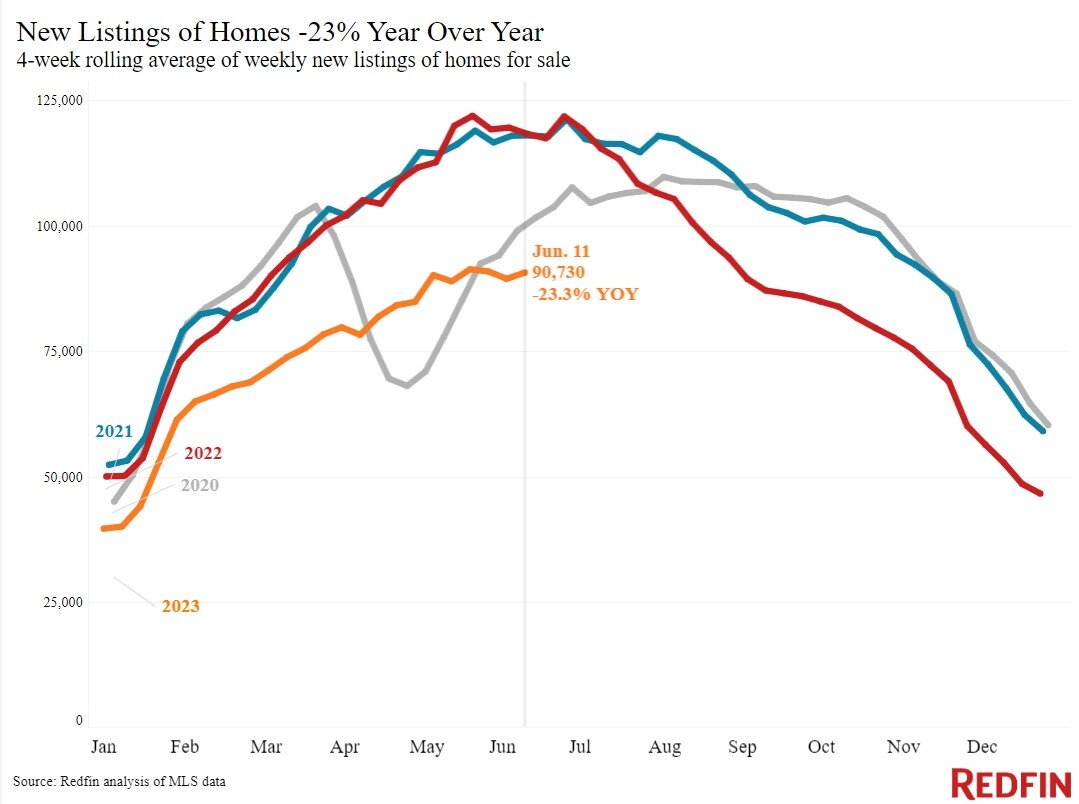

New listings dropped 23%, continuing a 10-month streak of double-digit declines. Those add to the deepening post-pandemic inventory shortage; there are 39% fewer homes for sale now than there were five years ago, in June 2018.

The inventory crunch is partly due to a homebuilding slump that's lasted for over a decade and partly to mortgage rates falling to record-low levels during the pandemic, then shooting up. Mortgage rates have more than doubled since 2021, landing at close to 7% this week. The record-low mortgage rates of 2020 and 2021 drove a home buying boom, depleting inventory. When rates started going up in the beginning of 2022, many would-be sellers backed off, failing to fill the inventory hole. Elevated rates discourage homeowners who would prefer to hold onto a comparatively low rate from selling.

Pending home sales are down 17% year over year, the biggest decline in over four months, but it isn't all due to a lack of demand. People are still showing interest in buying. Mortgage-purchase applications rose 8% over the last week, and Redfin's Homebuyer Demand Index--a measure of requests for tours and other services from Redfin agents--is up over the last two weeks and near its highest level in a year. That means there's a fair amount of pent-up demand, and many buyers will be ready to pounce when more homes hit the market. Demand outpacing supply is preventing home prices from falling drastically: The median sale price is down just 1.1%, the smallest annual decline in three months.

This week's economic news indicates that mortgage rates are unlikely to decline in the next few months, which may mean new listings stay low for the time being and the inventory shortage deepens. The latest inflation report shows that price increases have continued to cool, and the Fed announced that it will pause interest-rate hikes this month after nearly a year of increases but may hike a couple more times this year.

"The Fed's indication that there are more rate hikes to come is not what homebuyers want to hear. It's likely to keep mortgage rates elevated and may even push them up a bit," said Redfin Economics Research Lead Chen Zhao. "People who are sitting on the sidelines, waiting for mortgage rates to decline, should know that's unlikely to happen in the foreseeable future. If a home that's in your price range and has everything on your wishlist hits the market, there's no good reason to wait."

Leading indicators of homebuying activity:

- The daily average 30-year fixed mortgage rate was 6.95% on June 14, down from a seven-month high of 7.14% three weeks earlier but up from about 6.6% a month earlier. For the week ending June 8, the average 30-year fixed mortgage rate was 6.71%, down slightly from 6.79% the week before but still close to the highest rate since November.

- Mortgage-purchase applications during the week ending June 9 increased 8% from a week earlier, seasonally adjusted. Purchase applications were down 27% from a year earlier.

- The seasonally adjusted Redfin Homebuyer Demand Index was essentially unchanged from a week earlier during the week ending June 11, but up from two weeks earlier. It was up 7% from a year earlier, the third consecutive annual increase. Demand was dropping at this time in 2022 as mortgage rates rose.

- Google searches for "homes for sale" were up 15% from a month earlier during the week ending June 10, and down about 10% from a year earlier.

- Touring activity as of June 11 was up 20% from the start of the year, compared with a 4% increase at the same time last year, according to home tour technology company ShowingTime. Tours declined during this time last year as mortgage rates shot up.

Key housing market takeaways for 400+ U.S. metro areas:

- The median home sale price was $381,169, down 1.1% from a year earlier, the smallest decline in more than three months. Price declines have been shrinking for the last seven weeks.

- Home-sale prices declined in 31 metros, with the biggest drops in Austin, TX (-13.1% YoY), Las Vegas (-9%), Oakland, CA (-7.4%), Phoenix (-6.9%) and Los Angeles (-6.7%).

- Sale prices increased most in Miami (8.9%), Cincinnati (8.3%), Fort Lauderdale, FL (6.1%), Milwaukee (5.9%) and Virginia Beach, VA (4.8%).

- The median asking price of newly listed homes was $398,475, up 0.3% from a year earlier.

- The monthly mortgage payment on the median-asking-price home was $2,640 at a 6.71% mortgage rate, the average for the week ending June 8. That's down slightly from the record high hit two weeks earlier, but up 8% ($200) from a year earlier.

- Pending home sales were down 17.1% year over year, the biggest decline in more than four months.

- Pending home sales fell in all metros Redfin analyzed. They declined most in Providence, RI (-30.8% YoY), Portland, OR (-29.1%), Milwaukee (-28.2%), Seattle (-26.9%) and San Diego (-26.6%).

- New listings of homes for sale fell 23.3% year over year, roughly on par with the declines over the last two months.

- New listings declined in all metros Redfin analyzed. They fell most in Phoenix (-40.9% YoY), Las Vegas (-40.5%), Oakland (-39.6%), Seattle (-35.9%) and Anaheim, CA (-34.7%).

- Active listings (the number of homes listed for sale at any point during the period) dropped 6.3% from a year earlier, the third consecutive annual decline and the biggest drop in over a year. Active listings were essentially unchanged from a month earlier; typically, they post month-over-month increases at this time of year.

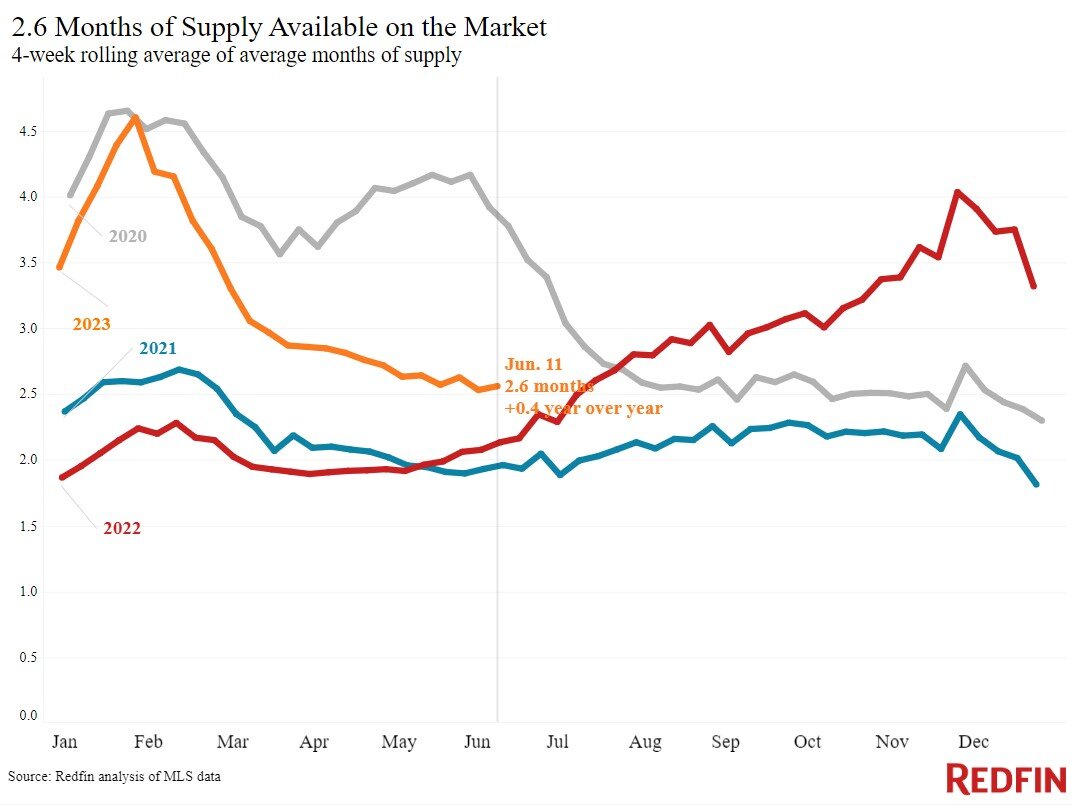

- Months of supply--a measure of the balance between supply and demand, calculated by the number of months it would take for the current inventory to sell at the current sales pace--was 2.6 months, up from 2.1 months a year earlier. Four to five months of supply is considered balanced, with a lower number indicating seller's market conditions.

- 33.2% of homes that went under contract had an accepted offer within the first two weeks on the market, down from 37% a year earlier.

- Homes that sold were on the market for a median of 28 days, the shortest span since September. That's up from a near-record low of 19 days a year earlier.

- 35.9% of homes sold above their final list price. That's the highest share since last August but is down from 54% a year earlier.

- On average, 5.3% of homes for sale each week had a price drop, up from 4.3% a year earlier.

- The average sale-to-list price ratio, which measures how close homes are selling to their final asking prices, was 99.9%. That means homes are selling for almost exactly their asking price, on average. That's the highest level since August but is down from 102.3% a year earlier.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Orlando's Housing Market Continues to Slow Down This Fall

- U.S. Mortgage Originations Predicted to Hit $1.95 Trillion in 2024

- Construction Input Costs in America Uptick in September

- Global Home Price Growth Further Slows in Mid-2023

- Home Values in U.S. Begin to Slip Late Summer

- Foreclosure Filings in U.S. Spike 34 Percent Annually in Q3

- U.S. Mortgage Credit Availability Upticks in September

- Retail Market is a Bright Spot for Manhattan Real Estate

- Residential Rents in U.S. Dip in September Amid Growing Apartment Supply

- U.S. Mortgage Rates Continue to Surge in October

- Greater Las Vegas Home Sales Down 10 Percent Annually in September

- Most U.S. Homebuyers Say Buying a Home is More Stressful Than Dating in 2023

- Mortgage Applications Dive 6 Percent Last Week in America

- Despite Peak Interest Rates, Global Housing Markets Improved in Q2

- U.S. Architecture Billings Index Reports Softening Business Conditions in August

- U.S. Home Price Growth Pace Upticks Again in August

- 10,000 Residential Properties Have Negative Equity in Hong Kong

- U.S. Pending Home Sales Dropped 7.1 Percent in August

- U.S. Mortgage Rates Reach Highest Level in 23 Years

- American Bankers See Weakening Credit Conditions Through End of 2024

- Palm Beach Area Residential Sales Uptick in August

- Driven by High Mortgage Rates, Pending Home Sales Drop 13% Annually in September

- Miami Area Residential Sales Slip 13 Percent Annually in August

- U.S. Home Sales Dip 15 Percent Annually in August

- Home Flipping Transactions Down in 2023, Profits Up

- U.S. Listings Inventory Rises 4 Percent in August

- The Fed Leaves Rates Alone for Now in September

- Mortgage Applications Uptick in U.S. Amid High Rates

- Single Family Rent Growth in U.S. Drops to 3-Year Low in July

- Greater Orlando Area Home Sales Down 16 Percent Annually in August

- Home Purchase Cancellations Accelerating in the U.S.

- U.S. Construction Input Costs Uptick in August

- U.S. Mortgage Credit Availability Upticks in August

- Monthly Property Foreclosure Activity Upticks in U.S.

- Greater Palm Beach Area Residential Sales Dip 5 Percent Annually in Mid-2023

- NAR Predicts Several U.S. Housing Market Outcomes

- Demand for U.S. Housing is Dropping as Prices Rise

- U.S. Homeowner Equity Decrease by $287 Billion Over the Last 12 Months

- 1 in 5 Millennials Think They'll Never Own a Home in America

- 1 in 8 San Francisco Home Sellers Is Losing Money at Closing in 2023