The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Pakistan Property Market Activity Flat in 2014

Residential News » Asia Pacific Residential News Edition | By Michael Gerrity | April 24, 2014 8:00 AM ET

Real estate consulting firm Zameen reports that Pakistan property prices remained stable across three of the country's major cities during the first quarter (Q1) of 2014.

Specifically, property markets of Lahore, Karachi and Islamabad, which had registered increases in prices throughout 2013, were lukewarm during Q1 of 2014 with little buying and selling activity.

Zameen.com's statistics show that prices for plots and homes in Lahore remained largely consistent with only minute increases and decreases during the first quarter. Property values in Islamabad and Karachi, too, showed a similar trend, where key areas performed consistently in Q1.

No significant changes were noticed in the trajectory of rental prices across key areas of the three major cities.

Property prices steady in Lahore

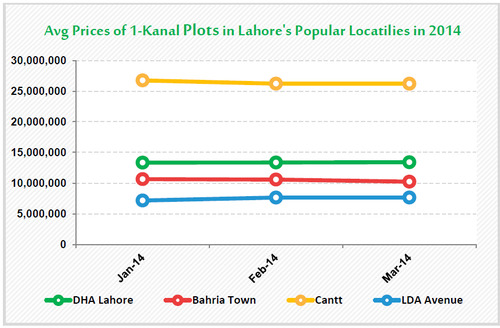

The property market for plots in Lahore had an uneventful first quarter. Compared to Q1 of 2013, demand seemed to have dropped significantly in Q1 of 2014, signifying that not many buyers or investors were active in the market. Consequently, there were no major spikes seen in property prices in Lahore.

The property market for plots in Lahore had an uneventful first quarter. Compared to Q1 of 2013, demand seemed to have dropped significantly in Q1 of 2014, signifying that not many buyers or investors were active in the market. Consequently, there were no major spikes seen in property prices in Lahore.In the first quarter of 2014, 1-kanal (500 yards2) residential plots in DHA Lahore showed a dip of 3.35%. Similarly, plots of the same size in Bahria Town registered a decrease of 3.93% in prices during the same period.

Homes in Lahore fared better than residential plots in terms of price appreciation, with 1-kanal houses seeing increases in value of 4.08% and 3.82% in DHA and Bahria Town respectively.

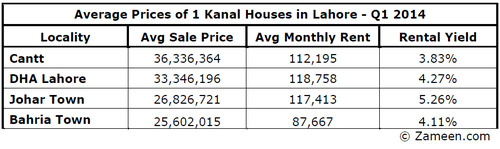

Lahore rental market remains stable

A comparison of average rents in DHA and Lahore Cantt revealed an interesting development on the rental front in Lahore. Cantt, which is generally a more expensive area to rent a 1-kanal home, lagged behind DHA during Q1 of 2014.

Zameen.com's statistics showed that the average rent for 1-kanal houses in DHA - Rs 118,758 in Q1 of 2014 - was 5.85% higher than houses of the same size in Cantt, where the average rent was Rs 112,195 during the same time period. Bahria Town, in contrast, was the most economical option of the three this quarter, with an average rent of Rs 87,667 for a 1-kanal house.

Zameen.com's statistics showed that the average rent for 1-kanal houses in DHA - Rs 118,758 in Q1 of 2014 - was 5.85% higher than houses of the same size in Cantt, where the average rent was Rs 112,195 during the same time period. Bahria Town, in contrast, was the most economical option of the three this quarter, with an average rent of Rs 87,667 for a 1-kanal house. The average rental yields for 1-kanal houses in DHA, Cantt and Bahria Town were 4.27%, 3.83% and 4.11% respectively in Q1 of 2014. Meanwhile, helped along by some modest price appreciation and sharp increases in rent, Johar Town boasted a staggering 5.26% rental yield during the same period of time. Those looking to invest in houses for a steady stream of rental income should take note.

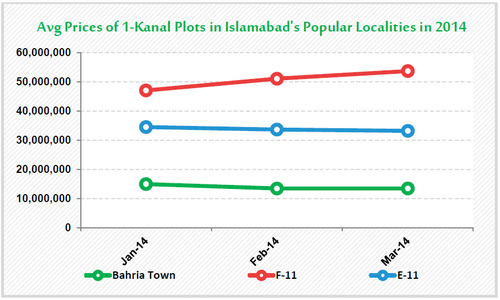

Islamabad property market sees slight fluctuation

Property prices in Islamabad also had a bit of a dry spell in the first quarter of 2014. Most of the CDA sectors, which were very popular in 2013, did not manage to register impressive appreciation. In fact, some of the most notable areas registered a fall in prices.

Bahria Town and E-11 exhibited a downward trend with a 4.85% and 0.61% fall in the prices of 1-kanal plots respectively. Interestingly, however, prices of same-sized plots in F-11 told a different story, registering an increase of 14.10% and providing further evidence that there was some upward activity in selective pockets of the Federal Capital despite a relatively sluggish market.

Bahria Town and E-11 exhibited a downward trend with a 4.85% and 0.61% fall in the prices of 1-kanal plots respectively. Interestingly, however, prices of same-sized plots in F-11 told a different story, registering an increase of 14.10% and providing further evidence that there was some upward activity in selective pockets of the Federal Capital despite a relatively sluggish market.Homes, on the other hand, have had a much better 2014 across the board so far. Zameen.com's statistics showed that 1-kanal homes in F-11, G-11 and E-11 saw price increases of 15.36%, 10.44% and 5.56% respectively.

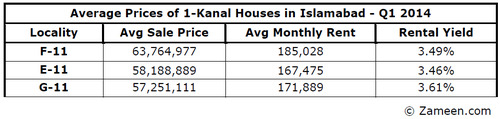

Capital's rental market performs consistently

From among the three most popular CDA sectors, E-11, G-11 and F-11, the first emerged as the most economical place to rent a 1-kanal home, with an average rental price of Rs 167,475 in Q1 of 2014 and an estimated rental yield of 3.46%.

Rents for residential units of the same size hovered around the Rs 185,000 mark in F-11 during the first three months of 2014, and with increasing prices and steady rents, Zameen.com's data showed a gradual drop in the sector's rental yield.

Rents for residential units of the same size hovered around the Rs 185,000 mark in F-11 during the first three months of 2014, and with increasing prices and steady rents, Zameen.com's data showed a gradual drop in the sector's rental yield.One-kanal homes in G-11 fared slightly better in terms of rent thanks to steady, albeit minute, increases. The sector boasted an average monthly rent of Rs 171,889 in the first quarter and a steady 3.61% rental yield.

Few changes in Karachi's realty market

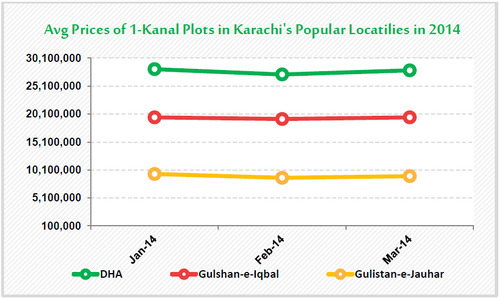

Karachi's real estate sector, which stole the limelight towards the end of 2013 with a flurry of activity and new projects, recorded a few dips here and there but largely remained on the up.

In DHA Karachi, 1-kanal plots registered a 6.40% rise in prices in the first quarter of the year. Even though this seems like a small percentage, translated into actual numbers it represents a tangible increase in prices for DHA properties.

In DHA Karachi, 1-kanal plots registered a 6.40% rise in prices in the first quarter of the year. Even though this seems like a small percentage, translated into actual numbers it represents a tangible increase in prices for DHA properties.Residential plots of the same size in Gulshan-e-Iqbal experienced no significant changes in the same time period, opening the year at an average price of Rs 19,500,000 and remaining steady till the end of the quarter.

Plots in Gulistan-e-Jauhar lost around 9.09% of their value in the same duration, however, falling from Rs 9,900,000 per 1 kanal in early January to around Rs 9,000,000 at the end of March.

Home prices hold steady in Karachi

Much like the plots, 500 yard2 houses in Gulistan-e-Jauhar recorded a 1.22% dip in prices. One-kanal houses in DHA Karachi also took a 3.11% blow to their values, but remained steady in terms of average rent and rental yield at Rs 174,047 and 4.04% respectively.

Gulshan-e-Iqbal, on the other hand, showed a 3.27% increase in home values in Q1 of 2014.

Barring a few, the older, more developed communities may not have done all that well in Karachi, but several of Bahria Town's projects in the city kept buyers and investors busy for the better part of the first quarter. Experts have opined that one of the reasons why the Lahore and Islamabad markets have exhibited bearish trends is because Bahria Town has attracted a large chunk of the overall investment.

Commenting on the current rates of plot files is difficult since they change every day, but what can be said with more certainty is that Bahria Town is showing the potential to become another successful project in the largest city of Pakistan.

Market likely to remain unchanged in Q2 2014

Zameen.com CEO Mr Zeeshan Ali Khan believes that the market is likely to remain unchanged in the second quarter of 2014 except for a few select areas across the major cities where prices may continue to inch up. "The second quarter is likely to be a quieter period compared to last year, but we're expecting better activity in the third and fourth quarters of the year," he said.

Pakistan's property sector is one of the largest recipients of foreign remittances, and overseas Pakistanis coming home for Eid play an important role in fueling market activity. These expatriates, who contribute a sizable chunk of the total investment that goes into the country's real estate sector, could have a hand in propelling reviving the market as we head into the second half of the year.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Orlando's Housing Market Continues to Slow Down This Fall

- U.S. Mortgage Originations Predicted to Hit $1.95 Trillion in 2024

- Construction Input Costs in America Uptick in September

- Global Home Price Growth Further Slows in Mid-2023

- Home Values in U.S. Begin to Slip Late Summer

- Foreclosure Filings in U.S. Spike 34 Percent Annually in Q3

- U.S. Mortgage Credit Availability Upticks in September

- Retail Market is a Bright Spot for Manhattan Real Estate

- Residential Rents in U.S. Dip in September Amid Growing Apartment Supply

- U.S. Mortgage Rates Continue to Surge in October

- Greater Las Vegas Home Sales Down 10 Percent Annually in September

- Most U.S. Homebuyers Say Buying a Home is More Stressful Than Dating in 2023

- Mortgage Applications Dive 6 Percent Last Week in America

- Despite Peak Interest Rates, Global Housing Markets Improved in Q2

- U.S. Architecture Billings Index Reports Softening Business Conditions in August

- U.S. Home Price Growth Pace Upticks Again in August

- 10,000 Residential Properties Have Negative Equity in Hong Kong

- U.S. Pending Home Sales Dropped 7.1 Percent in August

- U.S. Mortgage Rates Reach Highest Level in 23 Years

- American Bankers See Weakening Credit Conditions Through End of 2024

- Palm Beach Area Residential Sales Uptick in August

- Driven by High Mortgage Rates, Pending Home Sales Drop 13% Annually in September

- Miami Area Residential Sales Slip 13 Percent Annually in August

- U.S. Home Sales Dip 15 Percent Annually in August

- Home Flipping Transactions Down in 2023, Profits Up

- U.S. Listings Inventory Rises 4 Percent in August

- The Fed Leaves Rates Alone for Now in September

- Mortgage Applications Uptick in U.S. Amid High Rates

- Single Family Rent Growth in U.S. Drops to 3-Year Low in July

- Greater Orlando Area Home Sales Down 16 Percent Annually in August

- Home Purchase Cancellations Accelerating in the U.S.

- U.S. Construction Input Costs Uptick in August

- U.S. Mortgage Credit Availability Upticks in August

- Monthly Property Foreclosure Activity Upticks in U.S.

- Greater Palm Beach Area Residential Sales Dip 5 Percent Annually in Mid-2023

- NAR Predicts Several U.S. Housing Market Outcomes

- Demand for U.S. Housing is Dropping as Prices Rise

- U.S. Homeowner Equity Decrease by $287 Billion Over the Last 12 Months

- 1 in 5 Millennials Think They'll Never Own a Home in America

- 1 in 8 San Francisco Home Sellers Is Losing Money at Closing in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More