The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Hong Kong Most Expensive Office Market, Double All Others

Commercial News » Hong Kong Edition | By Michael Gerrity | January 20, 2015 8:45 AM ET

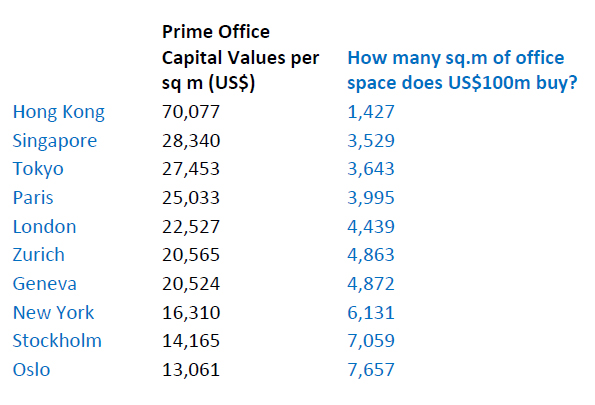

According to property consultancy Knight Frank, office space in Hong Kong is more than twice as expensive as prime commercial property in any other global city.

As part of its 2015 outlook for global commercial property, Knight Frank analysed capital values for prime offices in 32 cities, which showed that prime Hong Kong office space is valued at 70,000 US$ per sq. m. This is significantly more than second-placed Singapore at 28,340 US$ per sq. m and more than three times as much as that of the City of London.

Key global office market forecasts for 2015 include:

- New wave of Chinese investment from Ultra High Net Worth Individuals & State-owned enterprises

- Large-scale Japanese Pension Funds will diversify into global real estate

- Improving tenant demand for offices and falling availability will lead to rental growth

- Specialist property will continue to attract investors and become increasingly mainstream

Despite strong recent growth in capital values and an uneven global recovery, Knight Frank is forecasting further growth in cross-border investment in 2015, as investors seek better returns and diversification outside home markets.

Knight Frank believes that global investment volumes will rise by at least 10 per cent to over US$700bn in 2015, given the significant weight of capital targeting real estate. Finalised data for 2014 is expected to show that global investment volumes for commercial property exceeded US$600bn, around 15 per cent up on 2013.

Darren Yates, Head of Global Capital Markets Research at Knight Frank said, "The availability of land and land values are the fundamental issues that are driving rents and capital values in Hong Kong and Singapore, in particular.

"These locations have a very constrained supply of land, combined with high population densities and an abundance of successful global companies with an ability to pay higher rents."

Yates further commented, "Real estate capital markets have been increasingly buoyant and disconnected from occupational trends, which in turn have mirrored the unevenness of the global recovery.

Yates further commented, "Real estate capital markets have been increasingly buoyant and disconnected from occupational trends, which in turn have mirrored the unevenness of the global recovery."Investor focus thus far has been on transparency and liquidity, which has played well to the gateway cities such as London, Paris and New York. But demand is increasing for second and third tier cities where competition for stock is less intense and potential returns are higher."

Knight Frank's report also includes the findings from a survey of leading investment brokers from Sumitomo Mitsui Trust Bank on how the major Japanese pension funds will approach the real estate market in the coming years. The survey suggested that more than 70 per cent believe that Japanese pension funds will increase their exposure to real estate within one to two years, citing "stable income" as their key objective, followed by the opportunity to diversify.

North America will be the most popular region for Japanese Pension Funds investing abroad. Other Asian markets (18.8 per cent) and European cities (12.4 per cent) are expected to be far less popular initially.

Yates concluded, "With the top Japanese pension funds managing over US$2 trillion between them, even a small allocation to property is likely to have a significant impact on global real estate markets.

"Just a five per cent allocation to international property by the 15 largest Japanese pension funds would amount to US$100 billion. This is unlikely to occur overnight but will undoubtedly have a major impact over the next two to three years."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Investment in Asia Pacific Multifamily Properties to Double by 2030

- Multi-story Warehouses Are 15 Percent of Sydney's New Industrial Stock

- Manhattan Office Leasing Activity Lags in Q3 as Sentiment Remains Cautious

- Nonresidential Construction Spending Increases in America

- Office Conversions on Pace to Double in U.S.

- Hong Kong Office Vacancy Rates Stabilize After 4 Months of Increases

- Commercial Mortgage Debt Outstanding in U.S. Jumps to $4.60 Trillion in Mid 2023

- Architecture Billings Index in U.S. Remains Flat in July

- Commercial Mortgage Delinquencies Rise in America

- U.S. Data Center Demand Explodes in U.S., Driven by AI Growth in 2023

- Demand for Electric Vehicle Manufacturing Space Jumps Across the U.S.

- Global Cross Border Commercial Property Capital Flows Implode 52 Percent Annually in 2023

- 2023 Financing Constraints Rapidly Drive Down Construction Starts in U.S.

- New York City Named as U.S. Leader in Climate Change Resilience

- Tokyo is the City of Choice for Global Retailers in 2023

- Despite VC Cooldown, Life Sciences Represents 33 Percent of New Office Construction in 2023

- Despite Reduced Credit, U.S. Multifamily Developer Confidence Remained Positive in Q2

- Brisbane Office Market Enjoying Strong Leasing Activity in 2023

- Commercial Lending Dampened in 2023 by U.S. Market Uncertainty

- Asia Pacific's Commercial Investment Market Continues to be Challenged in 2023

- Despite Global Economic Uncertainty, Commercial Investment in Japan Grew in Q2

- U.S. Commercial Lending to Dive 38 Percent to $504 Billion in 2023

- Apartment Markets Across America Continue to Stabilize in 2023

- Cap Rates for Prime Multifamily Assets in U.S. Stabilize in Q2

- Ireland Office Market Making a Comeback in 2023

- U.S. Office Sales Total $15 Billion Halfway Through 2023

- AI and Streaming Drive Global Data Center Growth Despite Power Constraints

- Asia Pacific Logistics Users Plan to Expand Warehouse Portfolio in 2023

- Manhattan Retail Rents Continue to Rise in Q2

- Manhattan Office Leasing Activity Down 29 Percent Annually in Q2

- Commercial Property Investment in Australia Dives 50 Percent in 2023

- U.S. Architecture Billings Uptick in May

- Employees Return to Office Trend Growing in Asia Pacific Markets

- Exponential AI Growth to Drive Asia Pacific's Data Center Market

- Large Opportunity to Transform Australia's Office Market in Play

- Australian Industrial Rent Growth to Continue in 2023

- Corporate Relocations in U.S. at Highest Rate Since 2017

- North American Ports Volume Drops 20 Percent Annually in 2023

- Office Investment in Asia Pacific Remains Strong Despite Weaker Sentiment

- Australia's Build-to-Rent Properties Uptick on Lender's Wish List in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More