The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Hong Kong Still World's Hottest Market

Residential News » Asia Pacific Residential News Edition | By Kevin Brass | March 18, 2013 8:15 AM ET

Government measures implemented to slow soaring home prices in Hong Kong didn't work in 2012. Home values rose 23.6 percent for the year, the largest increase in the world, according to the Knight Frank Global House Index released today.

"With supply lagging, demand from mainland Chinese investors keen to get their slice of Hong Kong's real estate prices, has surged," the property firm reports.

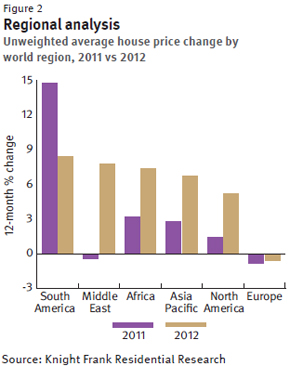

"With supply lagging, demand from mainland Chinese investors keen to get their slice of Hong Kong's real estate prices, has surged," the property firm reports.Overall prices in Asia Pacific increased by 6.7 percent in 2012, compared to a worldwide average of 4.3 percent, a result dragged down by "continuing challenges" in Europe. Greece posted the largest decline in the index, with prices falling 13.2 percent in 2012.

Other European markets showed signs of life. Turkey, Russia and Austria all posted gains of more than 10 percent. The best performing region was South America, where prices rose by an average of 8.4 percent.

Of the global markets, Dubai was the index's second best performer, reporting gains of 19 percent.

Of the global markets, Dubai was the index's second best performer, reporting gains of 19 percent."For several years the 'yo-yo' of the rankings, the Dubai market is finding its feet," the report concludes. "Stalled developments are being resurrected, sales volumes are rising and the level of market transparency is improving."

Unlike Dubai, Hong Kong prices have been rising steadily, despite the economic conditions around the world. Government restrictions on lending and new taxes, implemented out of concern about the market overheating, have apparently done little to prevent the price escalations, according to Knight Frank's data.

However, a new round of regulations, including an increase in the stamp duty on luxury homes, may finally have an impact, the property consultancy says. Sales of properties priced above HK$2 million now require a stamp duty up to 8.5 percent of the value of the property, more than double the previous tax.

"If the Hong Kong Government's latest efforts to increase stamp duty is a measure of their determination to cool price growth we can expect a return to more muted growth in 2013," Knight Frank says.

"If the Hong Kong Government's latest efforts to increase stamp duty is a measure of their determination to cool price growth we can expect a return to more muted growth in 2013," Knight Frank says.Knight Frank is generally cautious in its predictions for 2013.

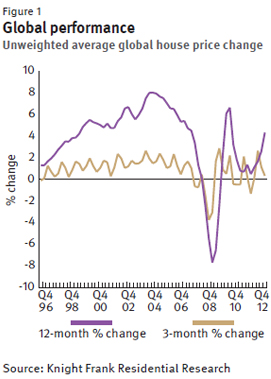

"2013 looks unlikely to deviate significantly from 2012's script," Knight Frank predicts. "The performance of the world's mainstream housing markets will depend on finding some economic stimulus, relaxing lending criteria and instilling buyer confidence. Europe presents the main downside risk acting as a brake on global growth."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Orlando's Housing Market Continues to Slow Down This Fall

- U.S. Mortgage Originations Predicted to Hit $1.95 Trillion in 2024

- Construction Input Costs in America Uptick in September

- Global Home Price Growth Further Slows in Mid-2023

- Home Values in U.S. Begin to Slip Late Summer

- Foreclosure Filings in U.S. Spike 34 Percent Annually in Q3

- U.S. Mortgage Credit Availability Upticks in September

- Retail Market is a Bright Spot for Manhattan Real Estate

- Residential Rents in U.S. Dip in September Amid Growing Apartment Supply

- U.S. Mortgage Rates Continue to Surge in October

- Greater Las Vegas Home Sales Down 10 Percent Annually in September

- Most U.S. Homebuyers Say Buying a Home is More Stressful Than Dating in 2023

- Mortgage Applications Dive 6 Percent Last Week in America

- Despite Peak Interest Rates, Global Housing Markets Improved in Q2

- U.S. Architecture Billings Index Reports Softening Business Conditions in August

- U.S. Home Price Growth Pace Upticks Again in August

- 10,000 Residential Properties Have Negative Equity in Hong Kong

- U.S. Pending Home Sales Dropped 7.1 Percent in August

- U.S. Mortgage Rates Reach Highest Level in 23 Years

- American Bankers See Weakening Credit Conditions Through End of 2024

- Palm Beach Area Residential Sales Uptick in August

- Driven by High Mortgage Rates, Pending Home Sales Drop 13% Annually in September

- Miami Area Residential Sales Slip 13 Percent Annually in August

- U.S. Home Sales Dip 15 Percent Annually in August

- Home Flipping Transactions Down in 2023, Profits Up

- U.S. Listings Inventory Rises 4 Percent in August

- The Fed Leaves Rates Alone for Now in September

- Mortgage Applications Uptick in U.S. Amid High Rates

- Single Family Rent Growth in U.S. Drops to 3-Year Low in July

- Greater Orlando Area Home Sales Down 16 Percent Annually in August

- Home Purchase Cancellations Accelerating in the U.S.

- U.S. Construction Input Costs Uptick in August

- U.S. Mortgage Credit Availability Upticks in August

- Monthly Property Foreclosure Activity Upticks in U.S.

- Greater Palm Beach Area Residential Sales Dip 5 Percent Annually in Mid-2023

- NAR Predicts Several U.S. Housing Market Outcomes

- Demand for U.S. Housing is Dropping as Prices Rise

- U.S. Homeowner Equity Decrease by $287 Billion Over the Last 12 Months

- 1 in 5 Millennials Think They'll Never Own a Home in America

- 1 in 8 San Francisco Home Sellers Is Losing Money at Closing in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More